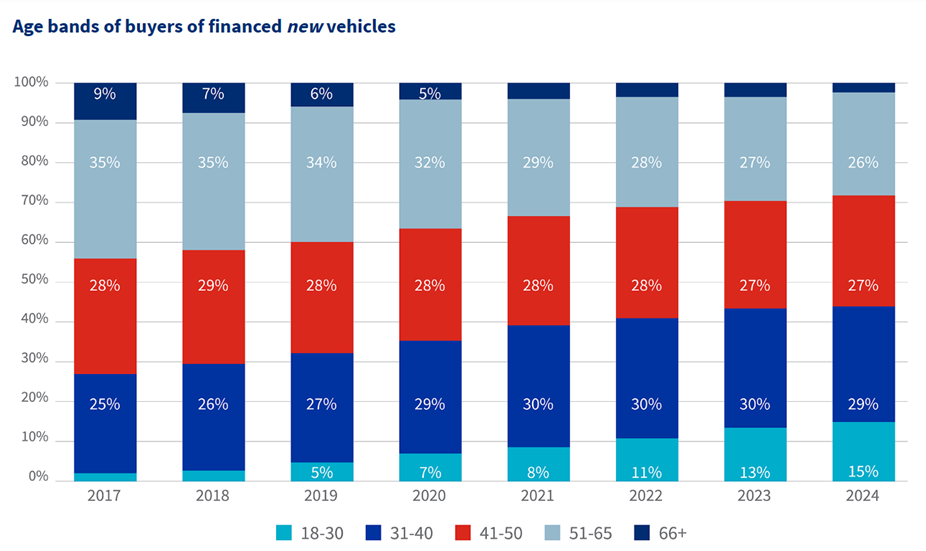

Andrew Hibbert, Auto Data Analyst & Team Lead at Lightstone, a provider of comprehensive data, analytics and systems on property, automotive and business assets, said Lightstone’s analysis of data gleaned from their transactional systems showed the established adulthood band (31- to 40-year-olds) was the largest segment financing new vehicle purchases with 29% of the market, up from 25% in 2017 where it placed third out of five age bands.

“Just as younger buyers increased their share of the vehicle finance market, older buyers have lessened in percentage terms”, Hibbert said. “The pre-retirement band of 51- to 65-year-olds, which made up 35% of sales in 2017, and was then the biggest consumer group financing new vehicles, now accounted for 26% in 2024”.

The second largest age group in 2017 was the midlife band of between 41 and 50 years of age and its 28% of the market had dipped marginally to 27% in 2024, but was still the second largest band.

The 66+ age group was down to just a 2% share in 2024 from 9% in 2017.

Hibbert said the trend in the financed used Light Vehicle segment since 2017 was much the same, with significant growth among those in the early adulthood phase, while the share of over-50s opting to finance a used vehicle was declining steadily (see graph below).

Hibbert said the Used Vehicle market differed in that there was a noticeable drop-off in the share of the midlife band, which wasn’t as evident in the New Vehicle segment, and the established adulthood group was reasonably constant, whereas among financed New Vehicles this group saw growth as well.

“Overall, the financed Light Vehicle age landscape had changed fundamentally over the last seven years (see graph below). The early adulthood group showed substantial growth, the established adulthood band remained steady, and the three age-groups catering for buyers over the age of 40 all experienced a diminished share of these sales”, he said.

Hibbert said the shifts in consumer behaviour could be attributed to consumers in the more mature age bands holding onto their vehicles for longer before making that new purchase and/or using other methods/avenues to make that vehicle purchase, the younger age groups opting to change their vehicles more frequently, and a change in outlook as to what big-ticket purchases to prioritise in the wake of the pandemic.