Virgin Money SA has announced an upgrade to its popular person-to-person payment app, Spot, to make it more accessible, increase functionality and make it safer and easier to use. For the first time, people without 3D secure bank cards will be able to use the app, thanks to the addition of a digital Spot Wallet that allows them to add and receive funds using their bank accounts.

Virgin Money SA CEO Andre Hugo says the upgrade addresses one of the main issues that Spot customers have been facing: namely, adding bank cards that weren’t internet-enabled and 3D secured. “With the previous version of the app, payments went directly into the credit or debit card linked to the app. With Spot 3.0, all payments and referral rewards are paid into your Spot Wallet instantly. New and existing customers can now simply link their bank accounts to cash out money from their Wallets.”

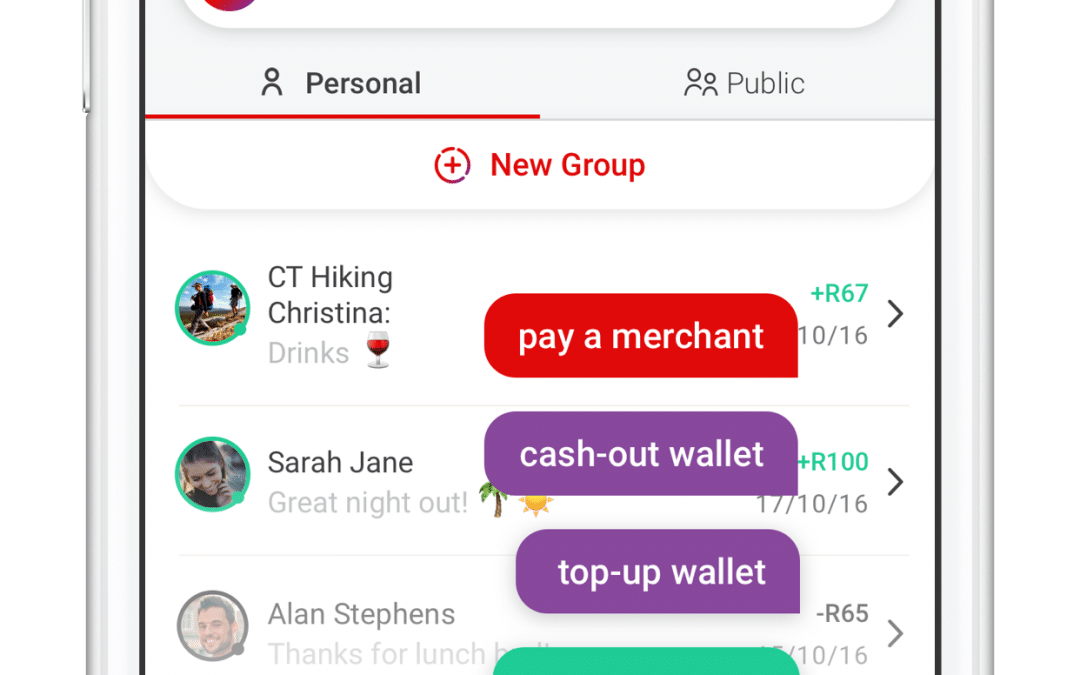

Another new feature of Spot 3.0 is the ability to pay merchants directly using the app. Wherever users see a ‘Pay with Spot’ sign, they can simply click the ‘Pay a merchant’ button and scan the merchant’s QR code. A national footprint of merchants will be available in the coming weeks and will be announced as they become available. Among the first merchants to officially partner with Virgin Money are the Cape Town 10’s rugby tournament and online ticketer Quicket, which will allow teams and spectators to make payments using Spot on the Quicket website.

Hugo says existing Spot customers who have downloaded the app, linked an internet-enabled bank card, and are transacting, will now have to add some additional details. “Customers will need to add a bank account to cash out money from their Spot Wallet; other than that, the experience for existing customers has been enhanced, as they’re able to send and receive money into their Spot Wallet in an instant, with no monthly subscription fees and no transaction fees. It’s simple, safe and social.”

The new version of the app has been built on Distributed Ledger Technology (Blockchain) because of its inherent safety and speed. When modelling the new platform for the app, Virgin Money’s product development team referenced the South African Reserve Bank’s “Project Khokha”, which was recently recognised globally as the best Distributed Ledger Initiative among Central Banks.

“Virgin Money Spot is the first retail micro-token exchange in South Africa. What this means for consumers is that we can transfer value in a fast, cost-efficient and transparent manner that protects against fraud and gives our customers peace of mind. All Spot transactions are recorded in our Blockchain ledger, which means they are tamper-proof. So, Spot is not only mobile, convenient and instant, it’s also secure,” said Hugo.

Spot has seen exponential growth in the past month, says Hugo. The number of Spot customers has grown by 900% in the last 22 days, with P2P payments and group pay increasing by 265%. Social networks of friends and families, small businesses, and community groups are embracing the ‘refer and earn’ feature, which has been pivotal in driving adoption. Every time an existing Virgin Money Spot customer refers someone with their unique referral code, Virgin Money ‘Spots’ R30 into each party’s Wallet.

“It’s a free, simple, safe and social way to ‘Spot’ your friends for that meal you shared, the tab they picked up, that sports wager you lost, or your share of the household running cost. Additional value-added products such as municipal bill payments, and data and airtime bundles will also be added to Spot soon,” said Hugo.