The rate of varied banking services that are available via mobile devices is growing daily as businesses and individuals are increasingly forced to prioritise digital transformation. One such development is Shyft. Ahead of the curb, Shyft is an app that offers a unique mobile forex trading solution that boasts unprecedented digital security measures with its facial authentication capabilities.

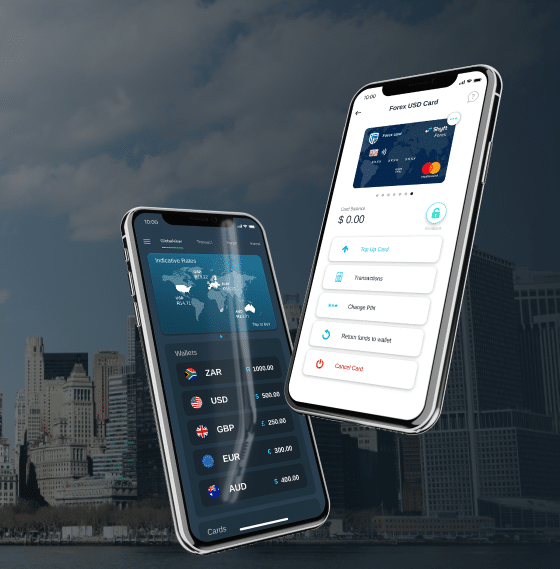

Voted as MTN’s Business App of the Year 2017, Shyft allows its Standard Bank account holders to buy, send and store up to R1million ($76 000) in foreign currency per year. It can store five of the major international currencies – US Dollars; Pound Sterling; Euros; Australian Dollars and ZAR Rands.

The app also provides investment services and Shyft Transfers which offer clients the freedom they need to get the most out of their financial portfolios. Maintaining these dynamic tech-driven, customer-led services requires a flexible and robust online security solution.

After a thorough screening and selection process, Shyft chose to partner with iiDENTIFii, a market leader in biometric identity and recent winner of the AI Leader Award at the future of HR and Africa Tech Week 2020. iiDENTIFii’s mandate to secure Shyft’s remote biometric digital facial authentication and automated onboarding processes.

Gur Geva, Founder and CEO of iiDENTIFii, says, “KYC, or Know Your Customer, is essential for businesses because if you don’t know your customer, how can you verify you’re providing services to a legitimate person? It was essential to Shyft that they were able to create a strong financial service portal bolstered by biometric facial verification.”

Shyft‘s caution in this matter was well founded as identity fraud and money laundering often go hand in hand. Financial and identity fraud are regarded as ‘silent crimes’ and can go undetected for quite some time. The reality is that this type of lawbreaking is experiencing exponential growth across the globe. Unfortunately, these crimes also lead to nefarious means of funding other illegal acts.

The South African Fraud Prevention Service (SAFPS) reported that in 2019, identity fraud via impersonation by fraudsters using real IDs and names had increased by 99%. It has also been discovered that fraudulent activities have cost the South African government over R1 billion in social grants during the COVID-19 pandemic. Geva believes that the only way to curb identity theft is to ensure that there are stringent security checks in place to verify identities.

Geva explains, “Because of the variety of currencies and clients Shyft works with, we needed to provide a service that meets all kinds of legislative requirements, while balancing the fundamental need for privacy across Shyft‘s client base. We believe in biometric facial verification which is when a person volunteers their live facial image to be used for their identity and financial security. Because we use a patented technology, specifically tailored according to respective ethnic groups, we can ensure the security of this facial authentication process regardless of geography and ethnicity.”

With Shyft‘s rapid growth and need to service their clients seamlessly, iiDENTIFii had to ensure that new and existing clients’ onboarding processes could be completed in under 30 seconds. This was achieved thanks to iiDENTIFii’s technology which is easily integrated into any mobile platform by means of a robust software development kit. Shyft can now customise functionality according to their specific requirements and clientele needs.

iiDENTIFii‘s proven and automated facial authentication process ensures that identities are authenticated remotely in a seamless and efficient manner. Supporting the company’s success is their golden-triangle-authentication approach, pioneered by the AI-engineering team at iiDENTIFii, which includes facial verification, proof of liveness, and a link to the Department of Home Affairs (DHA).

Shyft reports an ever-increasing clientele and, thanks to iiDENTIFii‘s innovative onboarding technology, Shyft are able to keep identity fraud at an all-time low.

In conclusion, Arno Von Helden, Head of Forex Solutions for Standard Bank, says, “iiDENTIFii‘s golden-triangle-authentication approach is arguably better than the traditional method of visiting a branch. With this approach, we rely on science and technology through the integration with the department of home affairs which eradicates human error discrepancies. We find a lot of comfort in this – knowing, and validating, that people are who they say they are.”