Internet and mobile apps, move over. The new industry disrupter is bot technology. Nedbank, one of the major banks in South Africa, is using a virtual call center solution, based on the Microsoft Bot Framework, that can understand the context of clients’ questions. It answers questions for which it is programmed at 10 percent of the cost of live agents. The bank envisions many other uses for the technology as part of a digital transformation intended to expand its competitive advantage.

The Internet was hugely disruptive to the financial services industry in the 1990s, creating new winners and losers and entirely new players. The next transformative wave hit the financial services shore in the 2000s, with the sudden burst of mobile apps that made anytime, anywhere banking a reality.

Let other banks tinker with websites and apps. Nedbank—one of the top four banks in South Africa and operating in seven African countries—is already riding what it believes will be the third disruptive wave in as many decades. It intends to be a global leader.

That third wave is cloud-based bot technology, which the bank can use to scale out its virtual workforce quickly and cost-effectively. With marketplace competition on the increase, the bank can exploit bot technology to provide a one-two punch of competitive advantage: provide better client service even as it reduces the cost of providing that service. And enhanced client service at lower cost is key to another Nedbank strategy: expanding its individual investor business while maintaining its traditional base in institutional and broker-based financial services.

“The shift to serving individual investors is a priority for us in the next 12 months,” says Steven Goodrich, Head of Technology for the Nedbank Wealth Division. “Bot technology plays a big role in that.”

Meeting clients in the call center

Here’s how: The market in which Nedbank envisions its greatest growth opportunity is more labor-intensive than its traditional markets. After all, it has to serve each individual investor directly in one-on-one interaction, rather than serving a single broker who, in turn, may serve scores of clients. Nedbank’s call center is where most of this interaction happens.

“We have an active online presence with our website and through social media, but individual investors prefer our call center to our website because it’s more convenient for them,” says Goodrich. “They don’t need to go to a site, remember their usernames and passwords, get security PINs for transactions, download an app, and so on. Our challenge is to replicate the convenience of call center interaction in more cost-effective channels and, in particular, in the channels that our clients prefer.”

Increasingly, the most preferred channel is the messaging app. Goodrich points out that the most popular apps in South Africa, and throughout much of the world, are WhatsApp, Facebook Messenger, Slack, and other texting apps. Most of the bank’s clients already use one or more of these. Nedbank’s goal is to encourage clients to use their existing preferred channel to engage with the bank.

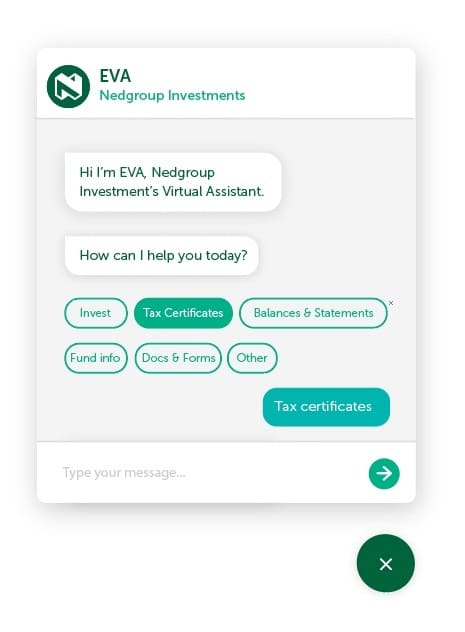

Introducing the Electronic Virtual Assistant

As an early step towards that goal, Goodrich and his colleagues wanted to see if they could use bot technology to handle call center interactions with clients through messaging. In August 2016 they began to develop a proof of concept for the Electronic Virtual Assistant (EVA), working together with Microsoft Digital Advisory Services and technology provider NML through its bot division, Atura. The proof of concept would test the interactions of bot-based virtual call center agents with clients for the top 10 most common inquiries. The long-term goal is to help set up Nedgroup Investments, the asset management division of Nedbank, for aggressive planned growth without having to add staff.

One of the first decisions for Nedbank and NML was which technology to use. NML had evaluated a range of popular bot platforms, finding some too inflexible, too expensive, or too basic for Nedbank’s needs. “Our clients usually have very specific requirements that a generic bot user interface cannot meet,” says Paul Cartmel, Managing Director at Atura. In Nedbank’s case, that included responding with the “tone” that the bank wished to project and enabling live agents to take over conversations when appropriate.

The technology that met the bank’s needs for flexibility, granularity, and cost-effectiveness was the Microsoft Bot Framework and the Microsoft Azure Language Understanding Intelligent Service. “With the Microsoft Bot Framework, Nedbank gets the power and flexibility it needs to make virtual agents a success,” says Cartmel. “For example, it can distinguish what callers want when they ask the same questions in different contexts. It was easy for us to get up to speed and remains easy to work with.”

In addition, Microsoft Digital Advisory Services provided relevant use-cases to help target the optimal use of artificial intelligence in the banking environment.

“That’s incredibly fast”

Nedbank and NML got the prototype for EVA up and running in three months and put a fuller version into production less than four months later. “That’s incredibly fast to launch a chatbot in financial services,” says Goodrich. He credits the easy-to-use technology in the Bot Framework, its connectivity with downstream messaging apps, and the instantaneous commissioning and decommissioning of infrastructure as needed.

The bulk of the development cycle, in fact, concerned linguistic rather than technology issues. “The technology never slowed us down,” says Goodrich. “Where we spent the most time was working with linguistic experts to help EVA identify the intent of questions to ensure appropriate responses. This localization is critical to the success of the chatbot service offering.”

For example, the answer to “Which is your highest-performing fund?” is different depending on whether the client’s previous question concerned equities or bonds. Successfully meeting those challenges required an iterative process that included people not typically involved in software development, most notably Nedgroup Investments’ marketing department.

Another big EVA function is filling out forms so that clients don’t have to. EVA prepopulates a form with information the bank already has regarding the client and asks questions to solicit the rest. While most people prefer not to fill out forms, they find it more acceptable to provide the same information in response to an agent’s questions, even when the agent is virtual.

80 percent of the inquiries at 10 percent of the cost

EVA went live in February 2017 and was so successful that many clients thought they were interacting with live agents. Some became frustrated when EVA didn’t respond to comments such as “please” and “thank you.” Nedbank refined EVA’s responses and posted content to make it clear to clients that EVA is virtual—and that they can switch to a live agent whenever they wish.

“EVA handles 80 percent of the inquiries for which it’s programmed at just 10 percent of the cost of live agents,” says Goodrich. “That becomes a significant saving as we roll it out more broadly. Even better, it frees up live agents for exception handling—managing the trickier calls that need live agents. That’s what the Microsoft Bot Framework does for us.”

Goodrich and his colleagues are even seeing benefits from EVA that they never anticipated. For example, live agents also use it as a support tool to quickly obtain marketing content and other information for their clients. “EVA is just an extremely easy way to find information,” he says. “As a related benefit, we’re getting more consistent answers from live agents because they’re using the same tool to research client questions.”

Currently, clients access EVA through the Nedgroup Investments website. The bank’s next step is to make EVA available through messaging apps—fulfilling its vision to meet clients through the channels they already use. It also plans to expand EVA to assist clients with transactions. And the bank is considering more uses for the Microsoft Bot Framework. After Goodrich presented EVA to colleagues throughout the bank, he received calls asking about the suitability of the Microsoft Bot Framework for insurance, vehicle financing, and business and retail banking.

“We have a clear vision of using digital transformation for competitive advantage,” says Goodrich. “We’re using the Microsoft Bot Framework to help turn that vision into reality.”

Learn more about the Microsoft Bot Framework.