Kelly is 25. Ambitious. Successful. Living her best life. But her biggest stress in life right now may surprise you. It’s not boyfriend problems, or bad hair day. It’s old-fashioned money habits that are killing her budget.

“I draw cash every Sunday, and it’s supposed to last me the whole week. But when it comes to girls’ night, I always have to draw more. I know I buy food and drinks during the night, but I lose track. I often end up lending money to my friends, but I don’t always remember who, or how much,” moans Kelly. “When I do remember, it’s always awkward asking for it back. I hate it.

“The problem with cash is that it just goes, and you don’t know where. And once it’s gone, it’s impossible to get back. But what’s the alternative?”

Kelly’s friend, Carmen, has no such issues. “Cash? Who needs it? Between cards and mobile apps, I’m sorted. I go shopping, buy lunch, uber around, no problem. I can’t remember the last time I actually went to an ATM – they charge you to draw your own money,” she says.

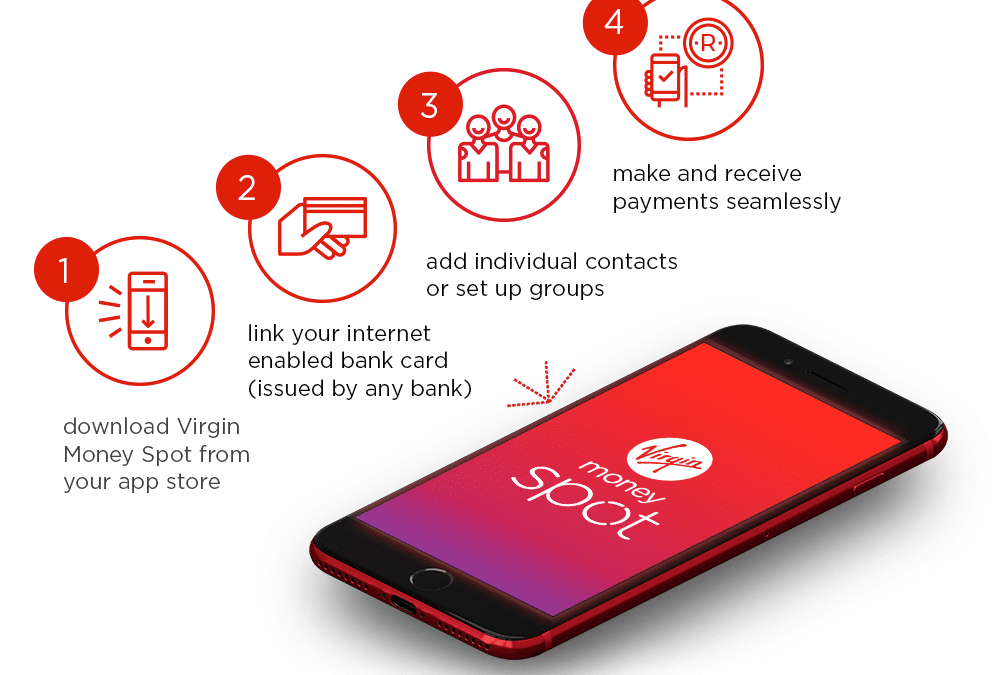

“And if any of my friends run short during a night out, I’ll just pick up the bill and request the amount back from them via my Virgin Money Spot app. It makes it so easy to ask for money back from friends without getting awkward – and I can see immediately when they pay.”

Virgin Money chief executive Andre Hugo says Carmen’s cashless existence is rapidly catching on in South Africa, with growing numbers of people using their mobile phones as their primary money management tool – with peer-to-peer payment apps like Spot making sending and receiving money as easy as sending an instant message.

“If you draw cash four times a month, you could be paying up to R65 in ATM withdrawal fees. That doesn’t sound like a lot – but leave that R65 in your bank account, at 0.5% compound interest per month, and after four years you’ve saved R3,516.36. Just because you didn’t draw cash,” says Hugo.

“On top of that, cash costs you money to draw and is unsafe to carry around. Don’t waste your hard-earned bucks on ATM fees! Use an app like Virgin Money Spot, which has zero fees and makes paying someone as easy as sending a text. Carmen needs to have a chat to Kelly, and soon. Nowadays, friends don’t let friends carry cash.”