Card payments have been traditionally associated with big businesses and small businesses would transact cash only, well, you’re never too small to accept card payments – in fact, it’s critical for all businesses, irrespective of type or size, to be able to accept electronic and mobile payments. If you’re not sure, whether or not your business should be accepting card payments

By this point, you’ve probably (we hope) heard about how Yoco is pushing boundaries for small business in Africa, used to cutting edge tech to build uniquely tailored solutions, like super-fast card machines and versatile online payments products, that accept all major cards and mobile payment methods.

If you’re wondering if Yoco is for you, here are some thought starters to help you tap into the cashless society

1. Fees go down (and stay down) as your business grows

Yoco is best known for leading the revolution on zero contracts or monthly fees for card machines and online payments. Everyone knows we only charge one low transaction fee, nothing else. But, did you know Yoco also lowers your fees the more you transact? After only three months of transacting with Yoco, your total transactions per month could qualify your business for even lower rates — based on our sliding scale. And once you’ve qualified, your fee will automatically be reduced, and it’ll never increase again — even if your sales or turnover take a knock in the future.

But what does the sliding scale really mean for your business?

Yoco fees start at 2.95% (ex VAT), whether you take online or in-person card payments. The first turnover threshold for a rate reduction is at R20 000, so everyone who transacts less than a combined (in-person and online) total of R20k per month will get charged the same 2.95% fee. Then, as your business grows, your transaction fee gets reduced – no matter what transaction fee you’re being charged, if sales stop for whatever reason, you pay R0 and your rates remain unaffected.

2. The free trailblazing software: our App and Business Portal

They’re built to run and manage your business for you, using either or a combination of both: the Yoco Business Portal is your business’s digital HQ, and the Yoco App is your very own personal assistant on the go! Here’s how they work:

The Yoco Business Portal

The Portal helps you to understand all the ins and outs of your business performance, and manage the practicalities of staff access, cash flow, and collating data from multiple stores. All reports can be downloaded into Excel and CSV format, from the cloud, anywhere in the world.

You’ll get a dynamic dashboard of key information, with live data that is simply yet powerfully organised and displayed for impactful insights and sophisticated convenience. Manage admin with features like inventory tracking and intuitive product organisation, so you can always find what you need, when you need it. Take a closer look and view sales reports at the touch of a button – broken down by number of sales, gross sales, payments, product, staff, categories, and brands.

The Yoco App

The Yoco App helps you run and manage your business from your phone or tablet, no matter where you are, in seconds. Recons are seamless, and creating sales reports are simple, with real-time insights to keep track of how your business is performing. See all your business transactions in one place — whether cash, card, mobile, or online. Catalogue and sort multiple product types, while keeping on top of stock and inventory. Keep track of your sales and view the details of each transaction. Add and manage staff access securely, and manage or send invoices via Whatsapp or email. The Yoco App does it all, simply and smoothly.

3. Free access to a bespoke e-commerce toolkit with Yoco’s Online Payment Suite

Yoco’s Online Payment Suite offers a selection of online payment solutions, with the right fit for your online payment needs, no matter how you do business. Here’s how it works: when you sign up with Yoco, you get access to Yoco Gateway, Yoco Link, and Yoco Vouchers. You don’t need to have or buy a Yoco card machine to use any of these three intuitive online products that cater to all aspects of your business. You get to tailor your payment solutions to however you get paid.

Yoco Gateway

Our e-commerce payment platform that lets you accept cards from your website or online store. It’s simple to set up with a few clicks — no special expertise required. Compatible with WordPress, Wix, WooCommerce, and Shopstar.

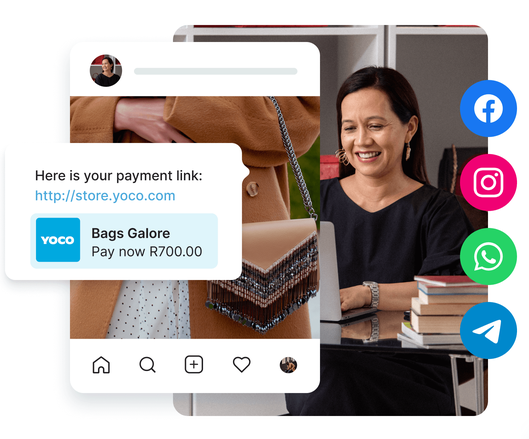

Yoco Link

An online payment link that can be sent via WhatsApp, SMS, email, on your invoices, or via social media. Yes, this means you can take card payments without a card machine or a website! It’s so simple, it’s genius. You won’t believe how many ways you can use this versatile product to get paid.

Yoco Vouchers

Vouchers create a great additional income stream, make for lovely gifts, and give loyal customers the chance to support their favourite businesses in a different way. What’s not to love? (Watch this for more.)

4. Get a cash advance (not a loan!) with Yoco Capital

Yoco Capital helps you grow your business with a cash advance. What’s so special about it? Well, it’s unlike any loan you’ve ever heard of! You can apply from the Business Portal in three steps that take less than five minutes, and get your money the next day. After paying one flat fee that you agree to (you heard right — no interest charged!), Yoco takes a small percentage of your future card transactions to pay back the cash over time. If your sales slow down (or stop), so do your repayments — no penalties, late fees, or collateral. We don’t get paid, till you get paid.

With the easily-accessible qualification criteria, Yoco opened up business capital for all small businesses — whether you sell fabric at the flea market, have a home beauty salon, wash cars — or anything in between. Yoco Capital offers transparency, affordability, and opportunity to small businesses across the country. Now if that doesn’t surprise you, I don’t know what will!