When South Africa entered its first lockdown on March 26th, 2020 to curb the spread of COVID-19, the local retail landscape changed forever as shoppers adopted new habits and preferences.

A study by McKinsey conducted in September 2020 found that 79% of South African consumers had tried a new shopping behaviour, and most intended to continue with that behaviour even beyond the pandemic.

For one of South Africa’s leading retailers, the ability to quickly adapt to changes in shopper habits due to the pandemic was paramount to its response to the initial stages of the lockdown.

“We needed a quick and affordable solution to collecting targeted consumer responses in real-time,” says Bridget Dore, Head of Customer Insights at Pick n Pay. “It was vital that we stayed up-to-date with any changes in our customers’ shopping behaviour. We approached Clandestine Insights to conduct ongoing shopper surveys to equip our teams with real-time data insights into our customers’ changing shopping habits.”

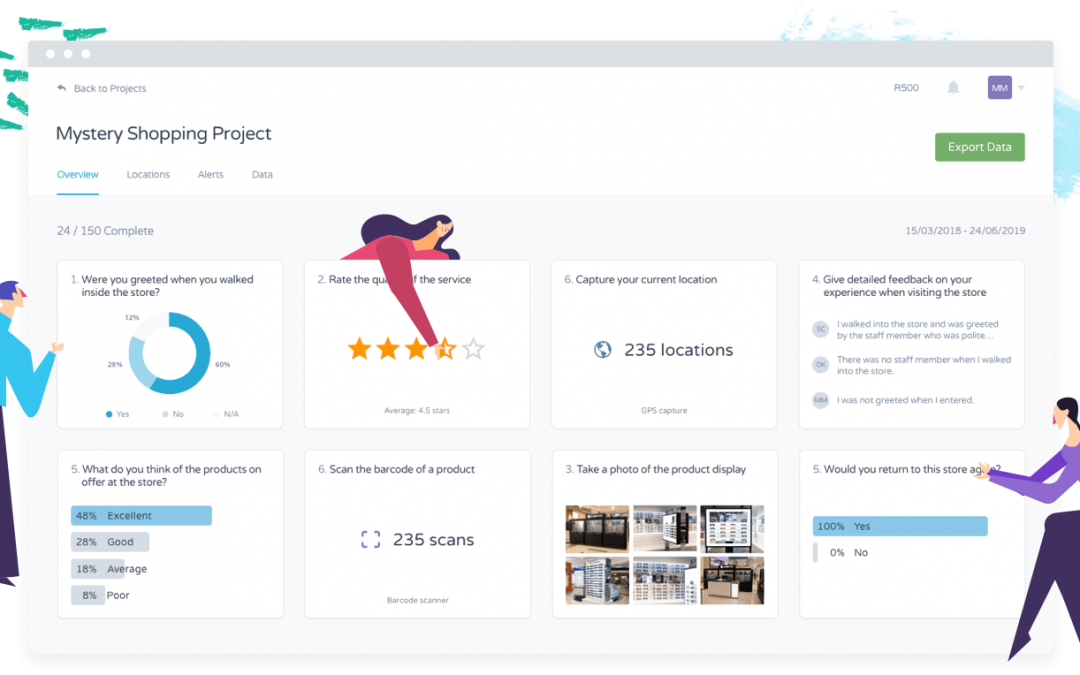

Clandestine Insights is a market research consultancy that specialises in on-demand surveys, mystery shopper and retail execution audits. It forms part of the Crossfin Ventures portfolio, the angel funding arm of African fintech investment holding company Crossfin.

At the time of the first surveys, Pick n Pay – like many other retailers – was still navigating the changes brought on by the country’s restrictive lockdown and the impact of the pandemic on shopper behaviour. “We needed to better understand the new ways shoppers were buying groceries, how often and from where, what items were prioritised, and a myriad other changes,” explains Dore. “It was also important to understand and address customer concerns from a health and safety perspective, including elements such as distancing markers, clear signage, and other health-related protocols.”

According to Mike Metelerkamp, Director at Clandestine Insights, the speed at which insights were gathered was a top priority. “Using our Echo platform, we helped Pick n Pay build capabilities to set up a survey on Friday afternoon and have accurate results ready by Monday morning, drawing on data from a demographically-representative consumer panel that matches the broader South African population. This helped decision-makers to discover ways to improve in-store environments and store offers to better match the latest customer expectations.”

To date, Clandestine Insights has surveyed close to 30 000 shoppers for Pick n Pay. Dore says some of the more interesting insights gained from the surveys include how concerns around the impact of COVID on SA’s economy continued to escalate, while fears around

contracting the virus declined over time. At the start of the pandemic customers chose to shop more online, closer to home, and across fewer retailers to avoid catching the virus, but their repertoire changed as they continued to seek value for money.

Metelerkamp says shopper behaviour is likely to continue changing as the pandemic and accelerated digitisation of services continue to disrupt old shopper behaviours. “Our mission is to provide brands with a simple platform to conduct affordable market research in minutes, from a panel of consumers representative of the broader South African population.”