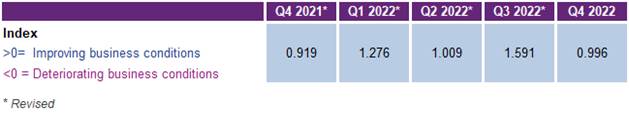

The Experian Business Debt Index (BDI), which reflects the relative ability for business to pay their outstanding suppliers/creditors i.e., the overall health of businesses in the economy, unsurprisingly declined sharply to a reading of 0.996 in Q4 2022 from 1.591 in Q3.

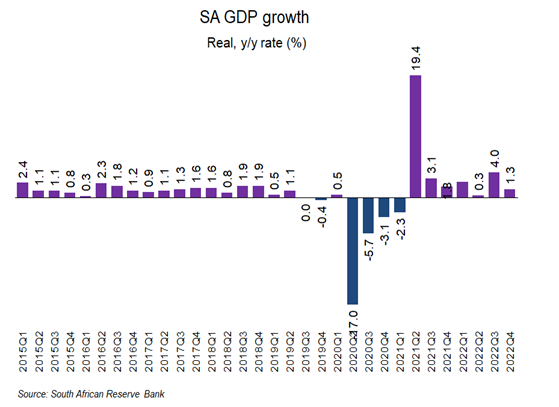

The decrease in the BDI in Q4 was greater than had been anticipated. Two factors dominated in producing this negative outcome. “First and foremost, the level of electricity load-shedding intensified sharply in Q4, with the predominant level of load-shedding moving to Stage IV in Q4 from Stage II in Q3. This was disruptive to domestic economic activity across a broad front and manifested in the deterioration in quarter-on-quarter GDP growth from 1.8% in Q3 to -1.3% in Q4. On a year-on-year basis, growth diminished from 4.0% in Q3 to 1.3% in Q4, says Jaco van Jaarsveldt, Head of Commercial Strategy and Innovation at Experian Africa.

Also contributing towards the deterioration in growth in Q4 was a two-week strike at Transnet in October, which negatively affected the country’s ability to export raw materials. This added to the negative impact on exports arising from a decline in commodity prices, had a further detrimental effect on GDP.

Higher interest rates and high inflation derived from sharp increases in food and fuel prices, partially linked to the war in Ukraine, as well as supply-side pressures resulting from disruptions to supply chains in the wake of Covid-19 restrictions in the previous two years, were also a partial contributor towards the reduction in domestic economic growth.

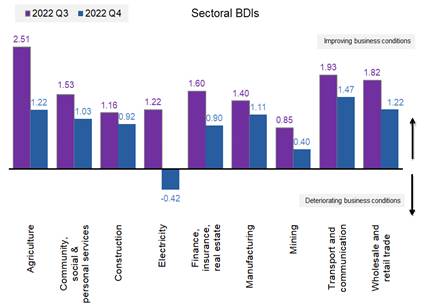

BDI by sector

There was a universal decline in BDI across all sectors. The steepest decline of all, not surprisingly given the increased intensity of load-shedding, was in the electricity sector.

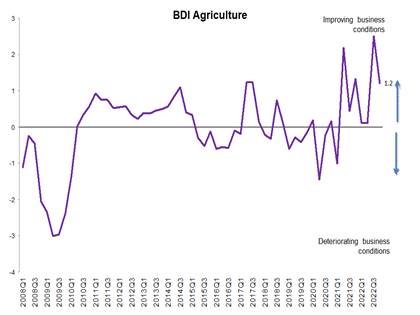

The other sector which declined steeply was the agricultural sector, on the back of a dramatic slowdown in the sector’s growth, with q-o-q growth plunging from an extremely high 30.5% in Q3 to a negative -3.3% in Q4. The plunge was mainly driven by energy-related challenges, as temperature regulation throughout the supply chain has become increasingly challenging as a result of the continued load-shedding. Deteriorating infrastructure adds further woes to the supply chain challenges faced by the agricultural sector.

“The consistent manner in which the BDI for all sectors declined in Q4, illustrates how the negative effects of intensified load-shedding filtered through across a broad band of activities in the economy,” said van Jaarsveldt.

Businesses show decreased ability to honour debt commitments

The decline in the BDI in Q4 was not driven only by macroeconomic factors.

The final three months of 2022 also witnessed a slight deterioration in the readiness with which businesses were prepared to pay off their debts, mainly due to the increased strain of doing business emanating from the weak overall business environment. By historical standards, the debt-age ratios were still relatively low. However, whilst marginal, the increases in both the 30-60 days and 60-90 days debt ratios contributed to the decline in the BDI.

“This points to some element of resilience within the economy’s private sector that stands as a barrier against a much more serious deterioration of the entire economy in the face of the energy shortage,” adds van Jaarsveldt.

Unfortunately, it is anticipated that there will be a further substantial decrease in the BDI in the coming quarters as the private sector’s ability to buffer broader electricity supply challenges and infrastructure failure wanes.

“Considering this forecast, businesses are encouraged to manage their debt effectively, particularly given that it is anticipated that the upcoming quarters will be more difficult due to increased consumer distress, which will increase the stress levels related to business debt,” concludes van Jaarsveldt.